Subcontractor Vehicle Expenses Guide: Save money through Tax-Efficient practices

- By admin

- August 11, 2023

- 4:08 pm

- No Comments

As a subcontractor, your vehicle is more than just a mode of transportation – it’s a powerful tool that can impact your finances. When managed efficiently, your vehicle expenses can lead to substantial tax savings. In this guide, we’ll explore how subcontractors can make the most of vehicle-related tax deductions, optimizing their finances for maximum benefit.

Understanding Subcontractor Vehicle Expenses

From getting to job sites to transporting equipment, your vehicle is essential to your subcontracting work. However, it’s important to note that not all vehicle expenses are deductible. To ensure you’re making the most of tax-efficient practices, let’s break down the key aspects to consider:

Eligibility for Deductions

Vehicle expenses can be deducted if the vehicle is used exclusively for business purposes. If you use your vehicle for personal reasons as well, you’ll need to calculate the portion of usage that’s business-related.

Types of Deductible Expenses

Generally, you can deduct expenses such as fuel, maintenance and repairs, insurance, road tax, and interest on loans for the vehicle. You can also claim a deduction for vehicle depreciation, reflecting the wear and tear the vehicle experiences over time.

Record-Keeping

Accurate record-keeping is vital. Maintain a mileage log that clearly outlines your business-related trips. This log should include dates, starting and ending locations, the purpose of the trip, and the mileage covered in order to get an accurate tax return.

Tips for Maximizing Deductions

Document Everything

Keep meticulous records of all vehicle-related expenses, including receipts, invoices, and bills. This documentation will support your deduction claims and provide a clear picture of your business-related vehicle costs.

Use Technology to Your Advantage

There are various apps and tools available that can help you track your mileage and expenses more efficiently. These digital solutions can streamline the process and reduce the risk of errors. Some examples of such tools are Zoho Expense and Rydoo.

Choose the Right Deduction Method

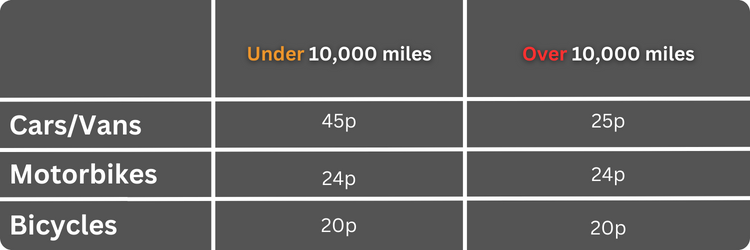

You have the option to choose between the standard mileage rate and the actual expenses method. The standard mileage rate allows you to deduct a fixed amount for each business mile driven. The actual expenses method involves tracking all costs related to your vehicle and deducting the actual expenses incurred. If you keep track of the mileage as well as petrol costs, the more cost-effective method can be worked out between the two. The rate will be 45p per mile if it is below 10,000 miles and 25p if it is above 10,000 miles.

The table below shows the tax reduction based on vehicle as well as the amount of miles travelled:

Separate Business and Personal Use

If you use your vehicle for both business and personal purposes, it’s crucial to maintain a clear distinction between the two. Keep separate records and only claim deductions for the business-related portion.

Consult a Tax Professional

The world of tax deductions can be complex. Consulting a tax professional who specializes in subcontractor taxation can help you navigate the nuances and ensure you’re maximizing your deductions within legal bounds. If you would like further information we can help: hello@subbie.tax or 01670 897407.