How much can you earn before paying tax?

- admin

- July 4, 2023

- 3:33 pm

- No Comments

There are a few things that determine how much you can earn before paying each tax year.

How much can you earn before paying tax?

The current amount of income you don’t have to pay tax on is the Personal Allowance of £12,570. If you claim Marriage Allowance or Blind Person’s Allowance you may get a bigger allowance, if your income is over £100,000 it may be smaller.

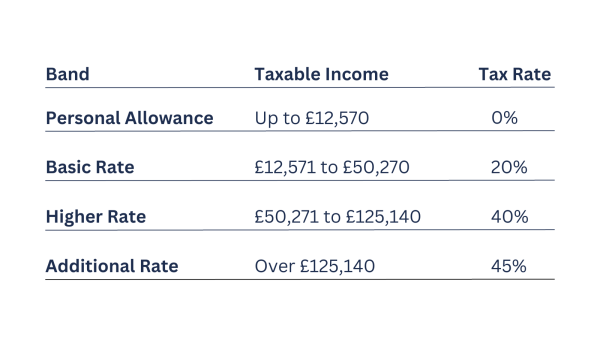

The table below shows the current tax bands along with the taxable income required for each band and the tax rate:

If you earn more than £125,140 on taxable income, then you do not get a Personal Allowance. If you earn below £125,140 then you will receive a personal allowance which will reduce by £1 for every extra £2 you earn

It was announced in November 2022 that the income tax personal allowance would stay at £12,570 until April 2028. The threshold for paying higher tax rates has also been frozen.

For further information visit the Government website here: https://www.gov.uk/income-tax-rates

If you have any concerns regarding tax don’t hesitate to get in touch with us, we would be more than happy to help.